June 2021

Global construction industry reaches peak after growth impetus.

The global construction industry is experiencing above-average growth following the Corona slump. At 502 points, the MCX reached a new all-time high on 10 May 2021.

Worldwide, the high demand for construction services and products shows a sharp contrast to economic slumps during the pandemic. Despite global uncertainties, the construction industry was able to perform above the global economic development.

However, rising material costs and scarce resources have clouded the sentiments in recent weeks. The index has dropped 4% since its peak on 10 May.

The challenges posed by the material shortage have become even more severe in recent weeks. As a result, plastics and wood are often not available – and there are significant price increases for steel and metals. According to the German Construction Industry Federation (ZDB), there is a growing fear of construction stops and short-time work in the industry.

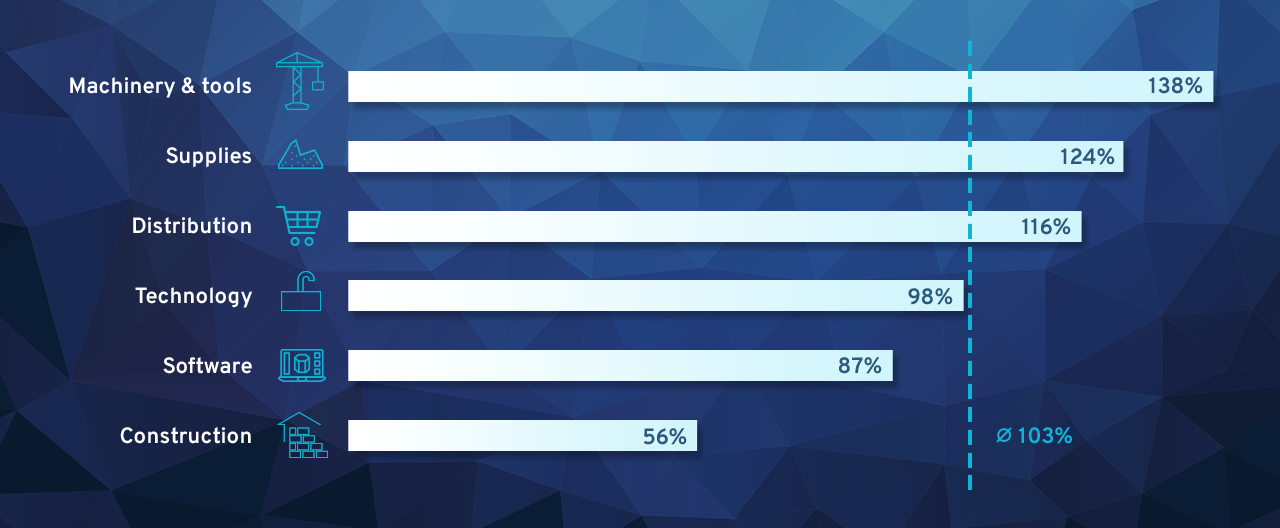

All construction segments profit, increase of 103% YoY on average

The construction industry as a whole has benefited from the economic recovery over the past 12 months, increasing the MCX value by 103% on average.

Driven by the recovery in demand from the world’s largest construction machinery market China, there is a positive outlook especially in the construction machinery & tools segment.

Distributors are benefiting from the continued strong demand in building construction and civil engineering. Private construction and renovation projects are also generating good business for stationary and online retailers.

The construction sector is traditionally a “slow adopter” of new technologies and innovations, which is primarily reflected in low production growth. However, the pressure for change is increasing with the pandemic and further digitalization and industrialization are driving demand for new technology solutions and software.

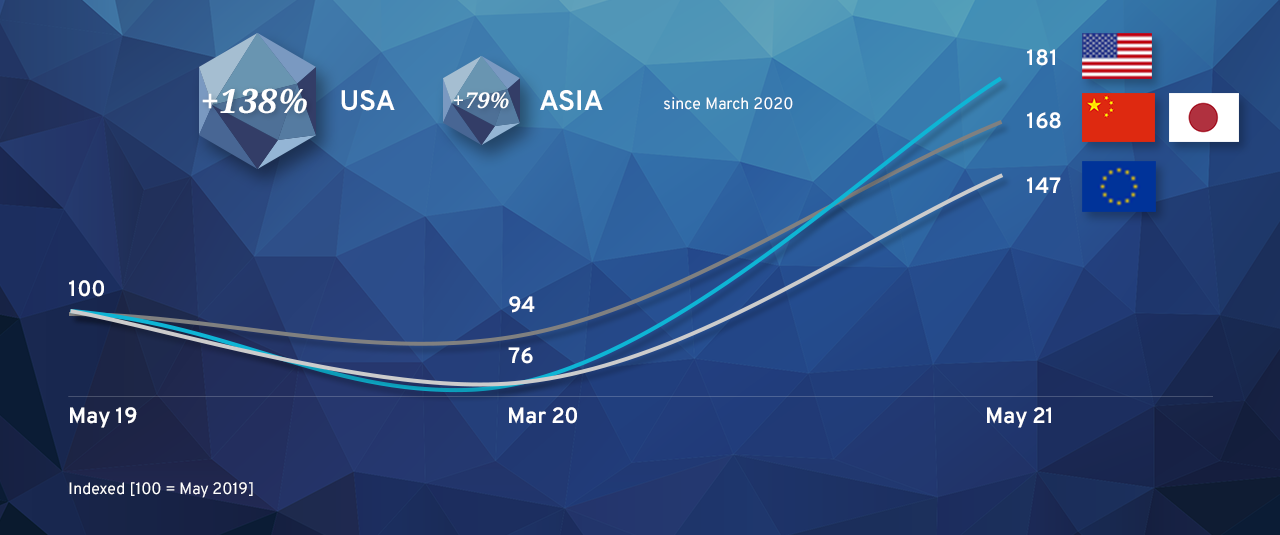

US companies challenge China

The Chinese dominance in the construction sector in recent years is being challenged by US companies.

The US construction industry managed the comeback of the year: A successful fight against the pandemic and an extensive economic stimulus package worth USD 1.9 billion boost the US construction sector. The Biden administration’s infrastructure modernization plans are improving the growth prospects of US construction companies.

In Asia, the Corona slump was comparatively weaker, this region has also showed a constant recovery. The index value for Asia has grown by 79% since March 2020.

Although the construction industry in Europe has been robust over the past few months, the decisive impetus for growth is lacking compared to the US and Asia. Reasons for this are the remaining impact of the third corona wave combined with unclear economic stimulus measures.

Shortage of raw materials clouds business prospects

The business situation in the global construction industry continues to be positive, however, the lack of material availability of globally traded raw materials such as wood, steel and petroleum is clouding expectations. The dilemma becomes clear when looking at the timber price development as an example.

Since a low in April 2020, the price of lumber has increased by nearly 300%.

Demand from the US and China exceeds supply on the world markets and causes supply bottlenecks for wood, in particular in Europe.

The lack of availability will increase prices for construction in the medium term. Even worse is a possible shutdown of construction sites, which would have negative consequences for the entire industry. The shortage of materials has the potential to bring construction sites to a standstill this summer.

Our Approach.

Munich Strategy is a strategy consultancy for the construction industry. We have developed the MCX (Munich Strategy Construction Index) to benchmark our clients’ performance with their peer group. Performance deltas indicate areas for action: Who outperforms the index? Who defies a downturn? What’s the impact of macro trends on segment level? What are the regional differences?

The MCX is the first tool that allows corporates and investors real-time insight into the construction industry’s status quo.

Your contact

T +49 (0) 89 1250 1590

presse@munich-strategy.com

Dr. Sebastian

Theopold